Who We Are

We are a group of average guys from all walks of life who got into spread betting to make additional money for ourselves and our families. Little did we know, that on 15th January 2015 when the Swiss National Bank scrap their EURCHF floor, we would be left with extraordinary negative balances with our broker IG Index (IG.Com). We were left with huge negative balances worth and our lives destroyed financially in minutes.

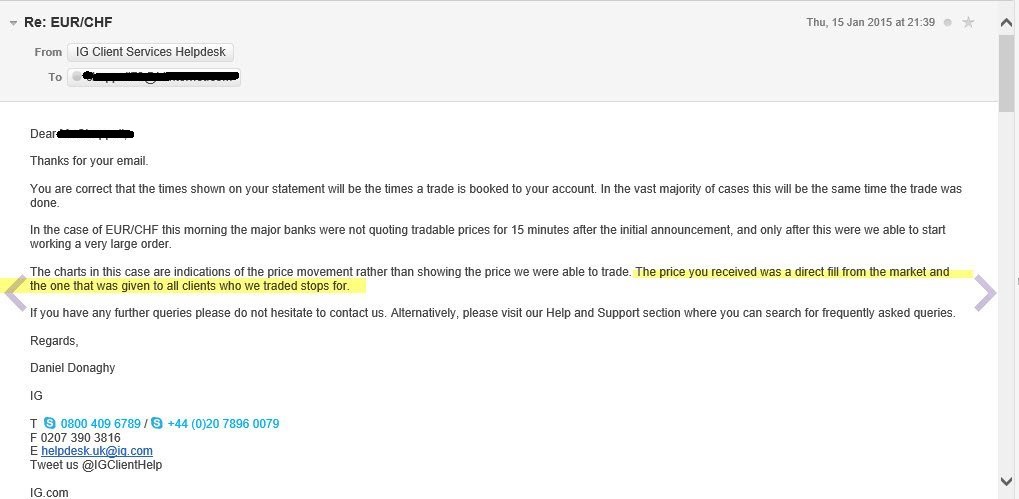

We understand the risks and assume responsibility for losses, however the losses were exaggerated by some inefficiencies in the processes taken by IG to close our positions. In fact, months later we found out that IG Index traded €100mn+ EURCHF in between the times of 09:32 and 09:39 whilst all the time telling clients there was no liquidity! SEE BELOW!

Please read our story and we hope we can persuade you to think twice about spread betting and which brokers you intend on using if you do. We sincerely do not wish this to happen to anyone else. If you think you are protected by the FCA...then you are wrong. FCA have done nothing regarding the substantial client losses in the industry due to the mishandling of trades and risk on the SNB event of Jan15, 2015.

Contact us igeurchfloss@yahoo.com

Please see the FCA Principles of Business below. We highlight failure by IG Group on principles 1,2,3,6,7,8 and 9. Do you disagree? If so, please read the rest of this site as well as the news stories link and we hope it changes your mind

Latest Story in THE TIMES- June 14th 2015

It’s a swizz: clients accuse IG over Swiss franc losses

Natalia Chumak said there were “systemic failures by IG at every level”

Written by Miles Costello

A group of IG clients who racked up millions in losses after betting against the Swiss franc have escalated their dispute with the online trading group, alleging that it is guilty of “systemic failures” in its treatment of customers.

Speaking publicly for the first time, the lawyer representing some of IG’s customers claimed that the problems in January were “a disaster waiting to happen”. Natalia Chumak, a partner at Signature Litigation, said that IG must have been aware that the turmoil that gripped trading in the Swiss franc was an “eventual possibility”.

She pointed to IG’s decision to remove a guarantee to have a floor on potential losses for bets relating to the euro against the Swiss franc. The guarantee had come after the central bank imposed a trading cap on its currency in 2011.

About 350 IG customers ran up losses of roughly £18.5 million on January 15 after the Swiss National Bank unexpectedly scrapped the cap and the Swiss franc surged by 30 per cent against the euro within a matter of minutes. Customers who had bet against the Swiss currency were left nursing heavy losses, with some complaining they did not know the “stop guarantee” was not there and that IG had compounded the issue by delaying exiting their positions.

IG, which also suffered losses, has recouped most of the minimal sums outstanding from customers, but is locked in dispute with a small group who together account for the lion’s share of the outstanding debts. As well as sophisticated traders, among those to sustain the biggest losses were a supply teacher, classical pianist and electrical engineer, although it is not known whether they are represented by Ms Chumak.

Ms Chumak said: “There have been systemic failures by IG at every level. Part of the picture is that IG failed to give its customers best execution of their trades on the day and it was also front-running, offloading its own risks before those of its clients. But there are wider, systemic failures at work that fit into a number of categories but all of which lead to the same conclusion — this was a disaster waiting to happen.”

IG’s disgruntled customers are in the process of pursuing a group complaint to the Financial Ombudsman Service. Some have complained to the Financial Conduct Authority, claiming that it has failed to treat customers fairly, and most are thought to be in regular dialogue with IG about the dispute.

Ms Chumak said IG’s customers wanted money that had been wiped off their accounts to be reinstated. They also want it to drop its claim for additional monies they might owe on the ground that the losses were preventable.

IG denied that it had prioritised its own positions, stating that all of the transactions it carried out after the removal of the currency cap were on behalf of customers, with whom it had been fully transparent in line with the rules.

A spokesman said: “IG absolutely maintains it acted in the best interests of its clients and closed all client positions as soon as was possible within the extreme market conditions that prevailed on the day. IG was neutral to the franc at the time of the announcement and executed all of its hedges to close out client exposure, in the best interests of IG clients.

“IG is transparent with its clients, with detailed risk information presented in all advertising, when clients sign up, and also always accessible on the IG website — fully in line with FCA requirements.” IG said that any “remaining affected” clients should make contact so that a means of settling their balances could be agreed, taking into account their circumstances.

FACTS GATHERED SO FAR

09:30-09:32 Some clients were filled at stops above 1.19 - PROBABLY 388 CLIENTS (715 MINUS THE 327 LEFT NEGATIVE)

09:32-09:39 IG traded its own risk ahead of clients - BUT THEY TOLD CLIENTS THERE WAS NO LIQUIDITY AT THIS TIME

09:35 Online trading halted - THEY WERE HAPPY TO LET PEOPLE INITIATE NEW POSITIONS WHEN THERE WAS NO LIQUIDITY!

09:42 MT4 feeds halted - THEY WERE STILL HAPPY TO PROVIDE PRICING TO MT4 PLATFORM USERS!

09:41-10:00 Client positions were aggregated and sold (using a combination of EURCHF and USDCHF) at a final average price of 0.9255 - WHY START SELLING USDCHF AT 09:41 WHEN IT WAS VERY LIQUID AND HIGHER FOR A WHILE BEFORE THEN?

10:00-10:15 The trades were allocated to client accounts at 0.9250 taking into account IG's spread - Yes, they charged a spread after inflicting so much pain already on clients - THEY TOLD SOME CLIENTS THEY DID NOT CHARGE A SPREAD

Is it not becoming clearer to people that IG Group have just handled this situation badly and that they are making some of the clients bear the losses?

Aren't the facts you see above clearly something you would not expect from a FTSE-listed, FCA regulated firm ?